About Payment Processor Integrations

Table of Contents

You can continue using your existing credit card solution with Syncro, and add integration to process credit card payments in Syncro at any time.

That said, there are many benefits to using a credit card processor that's integrated with Syncro:

- You won't have to track payments between your credit card processor and Syncro's invoicing system. Reconciling will be simpler or non-existent, thereby reducing data entry errors.

- It can help protect your business from costly data breaches.

- Your customers have a seamless payment experience.

Syncro supports several credit card payment processors; Worldpay is our recommended one:

| Feature | Worldpay | Stripe | PayPal |

|---|---|---|---|

| Apple Pay/NFC* | √ | ||

| EMV (Chip Cards)* | √ | ||

| Mobile App Support | √ | ||

| Keyed Credit Card Entry | √ | √ | |

| USB Swiper Credit Card Entry | √ | ||

| Store Card Numbers (for regular transactions and recurring invoices) | √ | √ | |

| Payment Link in Invoice Emails | √ | √ | √ |

| Take Payment from the End User Portal | √ | √ | √ |

| Void Transaction | √ | ||

| Refund Transaction | √ | ||

| Availability | U.S. only | Check Availability | Worldwide |

Note: Syncro does not support any offline payment methods or POS systems, including QuickBooks Merchant Services. If you want to use QuickBooks for accounting, you'll need a payment processor other than QuickBooks Merchant Services.

*As of January 30th, 2024, new Dejavoo terminals cannot be added to Syncro. Currently installed Dejavoo devices will continue to work as normal. No new card readers are currently supported.

Worldpay

Worldpay is Syncro's preferred merchant solution and the most complete integration available.

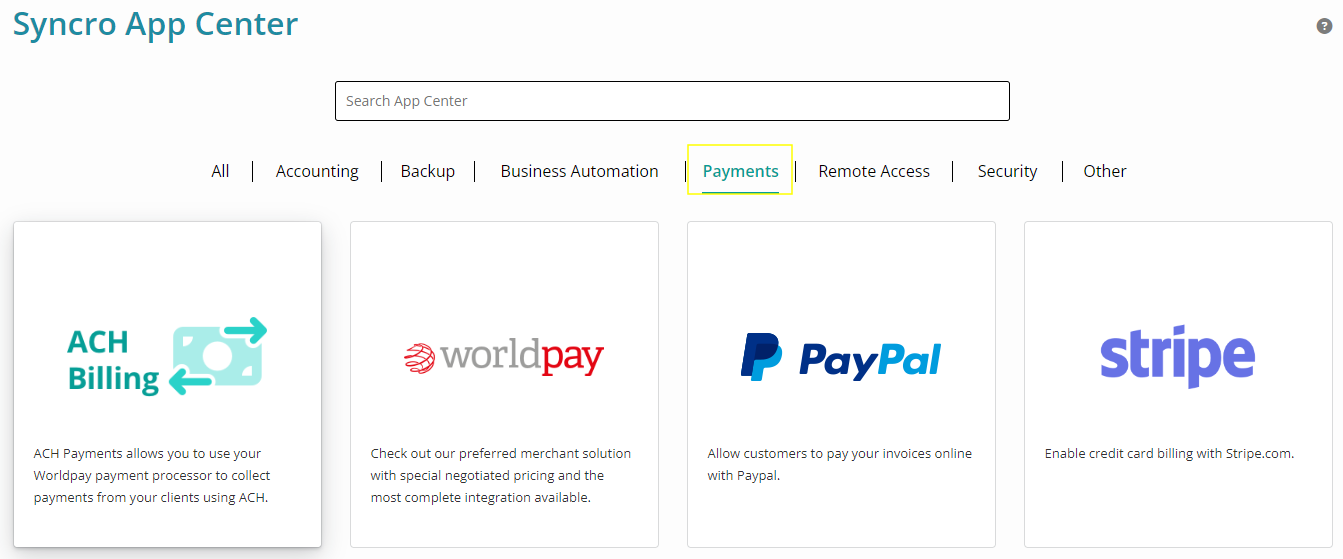

If you would like to integrate Worldpay, navigate to Admin > Integrations - App Center, filter by the Payments subtab, and then click the Worldpay app tile:

For more information about what Worldpay offers and more details about how to integrate Worldpay, see Set Up Worldpay.

Stripe

If you would like to integrate Stripe, navigate to Admin > Integrations - App Center, filter by the Payments subtab, and then click the Stripe tile. For more detailed instructions, see Set Up Stripe.

Note: Stripe lists "remote technical support" and "extended warranties" as restricted businesses by classifying them as high-risk businesses on their Prohibited and Restricted Businesses page. Please contact Stripe if you have any questions.

Stating:

"The following categories of businesses and business practices are restricted from using the Stripe Service ("Restricted Businesses"). Restricted Business categories may be imposed through Network Rules or the requirements of our Financial Services Providers. In certain cases, businesses listed below may be eligible for processing with explicit prior approval from Stripe. Note, however, that businesses that offer illegal products or services are never eligible to use the Stripe Services. The types of businesses listed in the right column are representative, but not exhaustive. If you are uncertain as to whether your business is a Restricted Business, or have questions about how these requirements apply to you, please contact us.

"By registering with us, you are confirming that you will not use the Service to accept payments in connection with the following businesses, business activities, or business practices, unless you have received prior written approval from Stripe. It is prohibited to use the Service for any dealings, engagement, or sale of goods/services linked directly or indirectly with jurisdictions Stripe has deemed high risk, such as Cuba, Iran, North Korea, Crimea Region, and Syria."

PayPal

Note: If you do not already have a PayPal account, you must sign up directly with PayPal first.

Follow these instructions to integrate PayPal.

External Credit Card Processors

If you want to continue using your existing credit card solution with Syncro, no setup is required.

All you need to do in Syncro is select "Offline CC" for the Invoice's “Payment Method” field. Syncro will then mark and display the invoice as “Paid.” See also Manage Payment Methods.

PCI Compliance

PCI Compliance is a set of security standards that ensure businesses that process, store, or transmit credit card information maintain a secure environment. It is required by credit card companies to make online transactions secure and protect them against identity theft.

Any merchant that wants to process, store or transmit credit card data is required to be PCI compliant, according to the PCI Compliance Security Standard Council.

When storing payment profiles, a credit card is stored in the payment gateway and the gateway returns a token that Syncro stores. Therefore, credit cards never exist on Syncro servers, and it's the payment gateway (not Syncro) that provides the PCI Compliance.

Please check with your payment provider for their PCI Compliance. Our payment providers— Worldpay, Authorize.net, Stripe, and PayPal—are all PCI Compliant.

For more information on PCI Compliance, please check with your gateway or visit the PCI Security Standards Council website.

Switching Credit Card Processors

If you decide to switch from one credit card processor or payment gateway to another, you will not be able to transfer all of the stored payment profiles—the saved credit cards—to the new processor.

That's because Syncro doesn't store the credit card data; the processor does, and they're not keen on transferring all those to a competitor.

Once you disable a credit card processor, any credit cards stored with them will become inactive. All the customers will need to re-save their credit card's under the new processor.